May 2021

Make or Buy - Trends in the European PET recycling.

The European Market for PET recycling is in motion. We analyze major drivers and trends for succesfully closing the loop at the example of PET bottles.

Undoubtfully, a lot is in motion on the European recycling market. Since the EU published its Circular economy action plan and its Plastics strategy, the days are counted for single-use plastics in many applications. Aspiring recycling targets are set for other plastic applications. This regulatory background is complemented by an ever-growing sensitivity of customers towards the utilization of closed-loop plastics, especially in packaging.

European targets for PET collection and the use of recyclates

PET is one of the most important polymers in the packaging sector, used for plastic bottles, utilized in a variety of shapes and volumes for the retail of beverages. The European Union has stipulated a collection rate for PET bottles of 90 % by 2029, meaning that by then 90% of the PET bottles placed on the market will have to be collected. This is likely to lead to the introduction of new deposit systems in many EU countries.

By 2030, PET bottles in the EU are ought to contain at least 30 % of recycled PET (rPET), further stimulating the market for rPET. But how does a closed loop for PET/rPET bottles work anyway?

Successfactors for a closed-loop

To create a bottle for your lemonade from recycled PET, food-grade rPET is required. The key to successfully closing the loop, as in most recycling ventures, is a separate collection. Therefor, countries with a successful deposit and collection system in place, come with a locational advantage. The sorted collection of PET bottles allows for a subsequently more (cost-) efficient recycling process, producing a high-quality rPET. Giving an example of high recycling input quantities and a well-advanced deposit system, the output of food-grade rPET in Germany leveled around 260 kt in the last year and was amongst the highest in the EU.

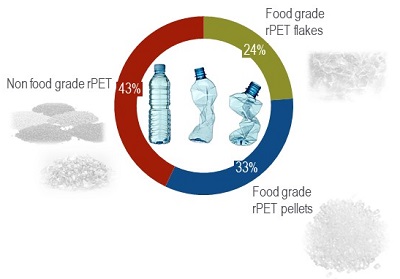

But not every piece of collected PET material is recycled into nice and clean rPET pellets in food-grade quality. About 40 % of the rPET in the EU is retailed in lower, non-food-grade qualities. Some 25 % of the recycled output is not processed to pellets but sold as rPET flakes. While food-grade rPET pellets are marketed for about 1,200 €/t and available volumes are not only limited but tied to long term supply contracts in many cases, we see a clearly increasing price tendency in the upcoming years.

But not every piece of collected PET material is recycled into nice and clean rPET pellets in food-grade quality. About 40 % of the rPET in the EU is retailed in lower, non-food-grade qualities. Some 25 % of the recycled output is not processed to pellets but sold as rPET flakes. While food-grade rPET pellets are marketed for about 1,200 €/t and available volumes are not only limited but tied to long term supply contracts in many cases, we see a clearly increasing price tendency in the upcoming years.

Thus, the next important building stones are strong partnerships along the value chain. With limited quantities available and prices on the rise, bottle preform manufacturers are depending on good relations with their suppliers for ensured rPET availability.

Best-practice at Schwarz Group

A successful example for an alternative concept is demonstrated at Schwarz Group. Recycling their own rPET and already utilizing it with a much higher share that the EU goals set out. “Saskia” water bottles retailed at Schwarz Group discounter chain “Lidl” contain up to 60 % rPET from own recycling operations. By making their own rPET, the Schwarz Group had to accept initial setup investments for an own recycling venture but can save up to 50 % cost per tonne and gained a high level of independence from the rPET recycling market.