June 2021

Managing the Change - Customer Behavior and Recycling Regulations

Petrochemical companies and the plastics industry are confronted with a changing market environment.

Numerous changes are resulting from the increasing importance of recycling aspects for economic activities. Accompanying the climate debate and the resulting climate targets at global, European and national level, plastics are in the focus of changing regulations. While the political will increasingly bans single-use plastics from our lives, other plastic applications remain an integral part of everyday life. However, even where the plastic product remains the most efficient and appropriate solution, an increasing substitution of virgin materials with recyclates is called upon. At the regulatory level, this is reflected in recycling quotas and required recyclate shares in new products. Mid-term, fixed recyclate use quotas can also be expected for selected application areas, e.g. in the packaging sector or for individual polymers. In addition, there are voluntary commitments by stakeholders along the entire plastics value chain.

However, this development does not remain a intangible construct of the political sphere. Ecological issues have outgrown the fringes of socio-political discourse.

Customer behavior reflects the change

It would therefore be presumptuous to assume that the changing mindset, or more precisely this increasing awareness of ecological sustainability and an unconditional emphasis on the circular idea to conserve our resources and reduce waste, would not have an impact on customer behavior and thus directly influence the economic success of all players along the value chain.

Decisive stimuli

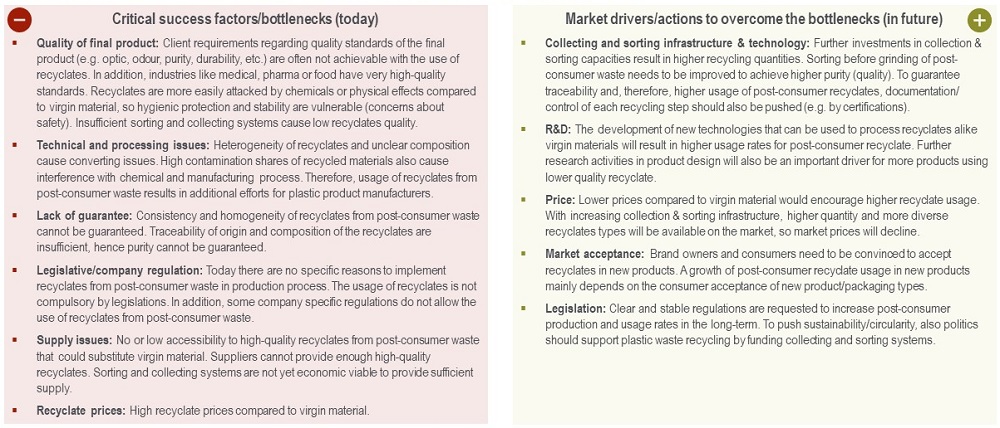

Regulatory and voluntary quotas for the use of recyclates will constitute decisive stimuli for the recycling market. Thermal recovery or, in some countries, landfilling was the most economical option for many plastic fractions where low or unstable demand made complex recycling processes unviable and a comparatively low crude oil prices resulted in cheap virgin materials. New sales opportunities for recyclates will change this and create a drive towards more recycling. Together with economies of scale, this will also act as a technology driver for the recycling of plastics.

Recyclates from polyolefins can serve as an example. In 2019, 3,100 kt of recyclates were produced from post-consumer PO waste in the EU (EU27+3). About 2,500 kt went directly back into the production of new products within the EU. This corresponds to a recyclate share of approx. 9%. With the current market development, a doubling of rPO production and demand is forecast by 2025.

This trend results in new questions, Players along the value chain need answers to. They are confronted with additional requirements and new interrelationships in the markets, and must take into account changes in the regulatory environmet as well as the adapted behavior of other parties involved. At the same time, new potentials are emerging that need to be strategically accessed and seized.

New opportunities come with new challenges

At Conversio, we are also feeling this change. The focus of our customers is increasingly shifting from pure material flow considerations towards a more analytical, quantitative and descriptive nature, dealing with qualitative and strategic challenges including the development of new business models. With our many years of experience and strong ties in the plastics market, we analyze the new rules of the "playing field" for our clients, their effects along the value chain as well as on the respective business model.

We access opportunities, show ways for a successful market entry and identify possible partners for joint ventures or new business areas. Where are the greatest opportunities for our company in the future? Where do we need to position ourselves? How do we shape our supply and value chain? We will provide you with answers to the most frequently asked questions at present.